TRANSPARENT GOVERNMENT

Transparency Award

Hutto Fire Rewcue is Recognized for Their Commitment to Fiscal Accountability in Local Government by The Comptroller’s Transparency Stars Program.

In 2017, the 85th Legislature passed a transparency bill requiring certain special purpose districts (e.g., Emergency Services Districts) to annually provide records and other information concerning finances and tax rates to the Comptroller of Public Accounts (See Senate Bill 625 [SB 625] https://comptroller.texas.gov/

Sound financial policies establish a foundation for the fiscal strength and stability of Williamson County Emergency Services District #3. These financial procedures guide the Williamson County Emergency Services District #3 Board of Commissioners and Executive Staff as they make fiscal decisions regarding resource allocations and annual appropriations. These financial policies assure sound stewardship of taxpayer dollars as they guide Williamson County Emergency Services District #3 in the planning of expenditures and revenues for public services and ensure budget flexibility and structural stability to weather economic cycles. The financial health of Williamson County Emergency Services District #3 must be maintained at the highest level to assure resources are available to meet the community’s ever-changing needs.

In The Perryman Group 2022 Report The Economic Benefits of Cost Savings Associated with Emergency Services Districts: An Analysis Including Specific Regions Across Texas, Williamson County Emergency Services District #3 was identified as the most cost-effective emergency services organization in Williamson County. Williamson County Emergency Services District #3 continues to maintain our process of following a conservative approach to fiscal management that enabled this designation. Budgets for Williamson County Emergency Services District #3 are always balanced – revenues and expenditures are equal – as required by the laws of the State of Texas.

The growth of Williamson County Emergency Services District #3 involves the ongoing implementation of the 2019 Williamson County Emergency Services District #3 Community Risk Assessment-Standards of Cover, the Hutto Fire Rescue/Williamson County Emergency Services District #3 Community Driven Strategic Plan 2020-2023, and the Hutto Fire Rescue/Williamson County Emergency Services District #3 Master Plan/Capital Improvement Plan: FY18-19 – FY27-28. The budget for Williamson County Emergency Services District #3 always maintains a careful balance – focusing on both managing through today’s volatile economy while continuing to maintain a long-term planning perspective and meeting the demands of the citizens. Williamson County Emergency Services District #3 is mindful that this pursuit and investment in these plans during this period of economic turmoil is challenging. Also, the continued implementation of the ISO-PPC report resulted in a Class 1 insurance rating in the City of Hutto and the rural area of Williamson County Emergency Services District #3 – an insurance savings for everyone.

Through the support of the Hutto Community and the dedicated personnel delivering emergency services protection, Williamson County Emergency Services District #3 will continue to improve the quality of fire and emergency service provided. But Williamson County Emergency Services District #3 must not lose sight that this is the “taxpayers’ money”. It must be managed daily. Williamson County Emergency Services District #3 must continue to remain fiscally responsible even though it is a challenge due to Texas legislative financial constraints. Williamson County Emergency Services District #3 will continue to provide the level of service that has come to be expected from taxpayers. In turn, Williamson County Emergency Services District #3 will continue to bring a higher quality of life to the residents of the Hutto community.

Financial Summary

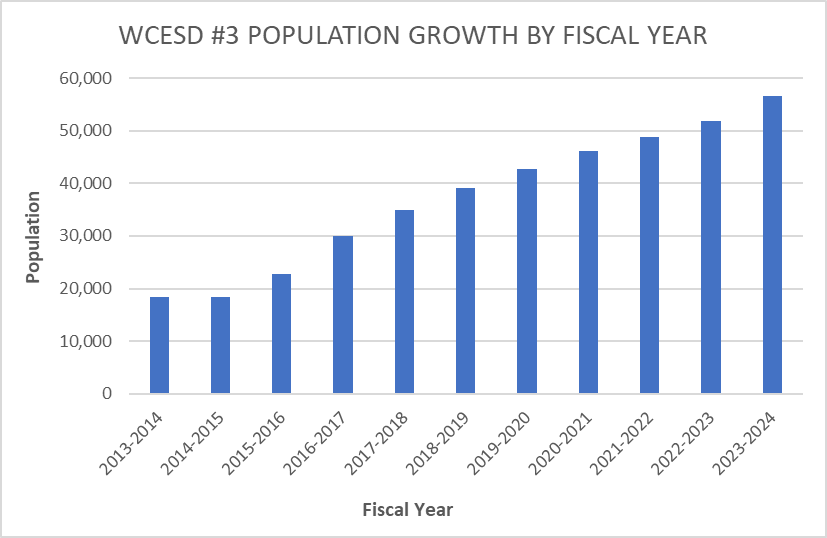

Williamson County Emergency Services District #3 Population Growth (Average per Fiscal Year = 12.88%)

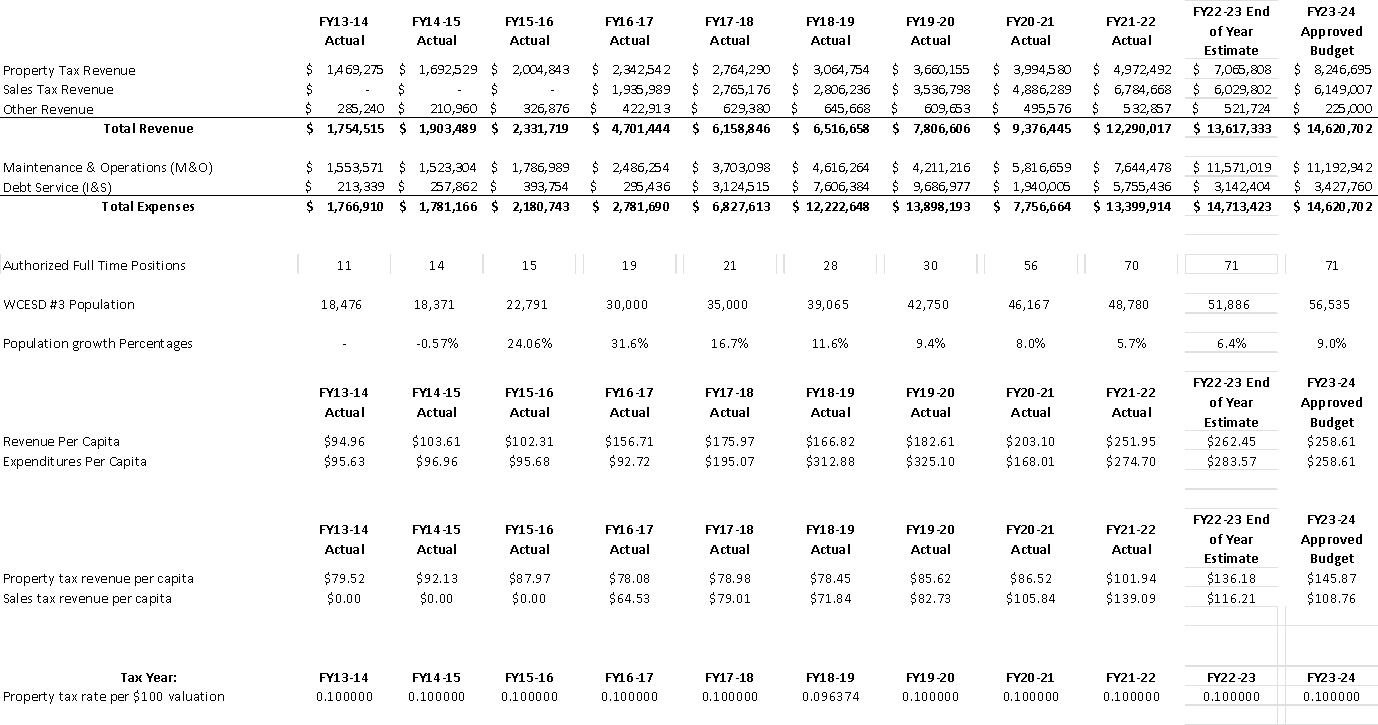

Williamson County Emergency Services District # 3 Revenues and Expenditures

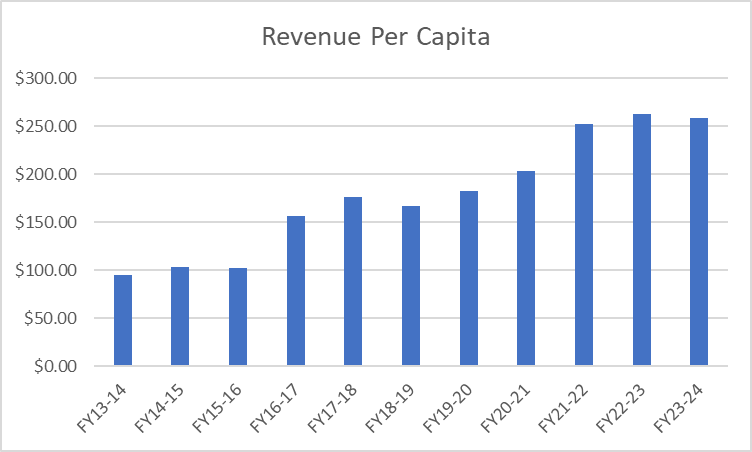

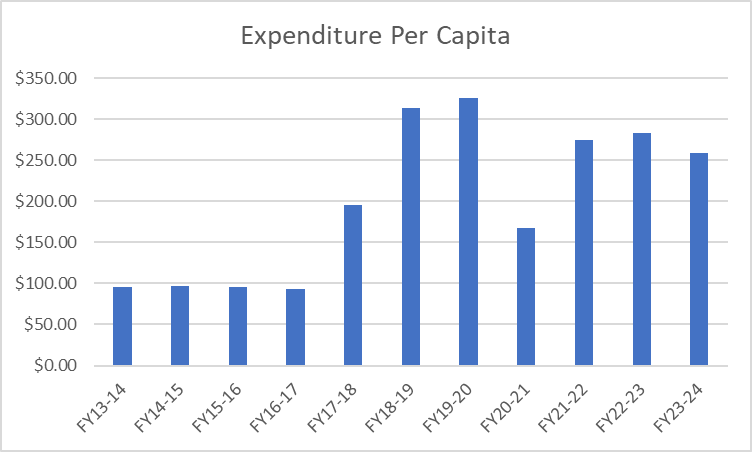

Williamson County Emergency Services District #3 revenue per capita has risen over the past few years due to an increase in population, construction of new residential and retail establishments, along with a significant increase in Williamson County property values.

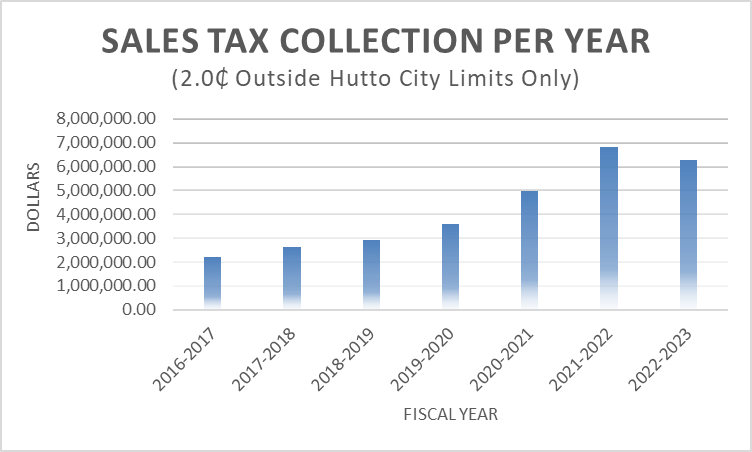

Sales tax revenue has increased because of this growth as well. Williamson County Emergency Services District #3 expenditures per capita continues to rise as Williamson County Emergency Services District #3 adds new emergency response staff positions, purchases equipment, and builds additional fire stations needed to respond to increasing call volumes.

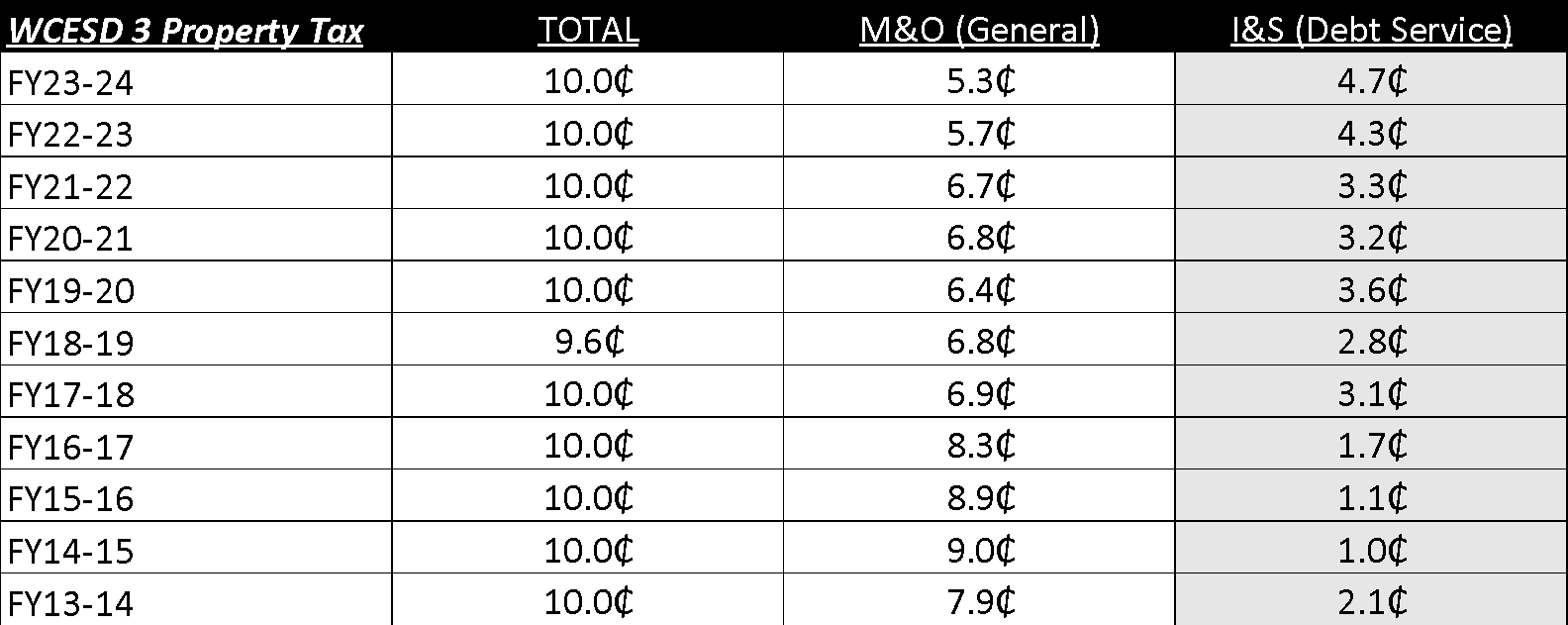

Property Tax Rates

The maximum Property Tax rate that Williamson County Emergency Services District #3

can levy is $0.10/$100 of property valuation. This 10₵ Property Tax cap is established by

the State of Texas Constitution. All purchases (people, equipment, apparatus, facilities)

must be made at or below this 10₵ Property Tax cap based on the adopted budget. These

purchases are known as Maintenance and Operations (M&O) and Debt (Interest &

Sinking [I&S]) funds. A complete property tax history in Williamson County Emergency

Services District #3 can be found here.

Maintenance and Operations (M&O)

Williamson County Emergency Services District #3 has included detailed maintenance and operations information on this page for transparency purposes. Williamson County Emergency Services District #3 maintenance and operations is supported by a portion of the Total Property Tax levied per year. Williamson County Emergency Services District #3 Board of Commissioners approved financial policies guide all revenues and expenditures that are considered M&O and is reviewed annually during the fiscal year Budget development process.

Debt (Interest & Sinking (I&S))

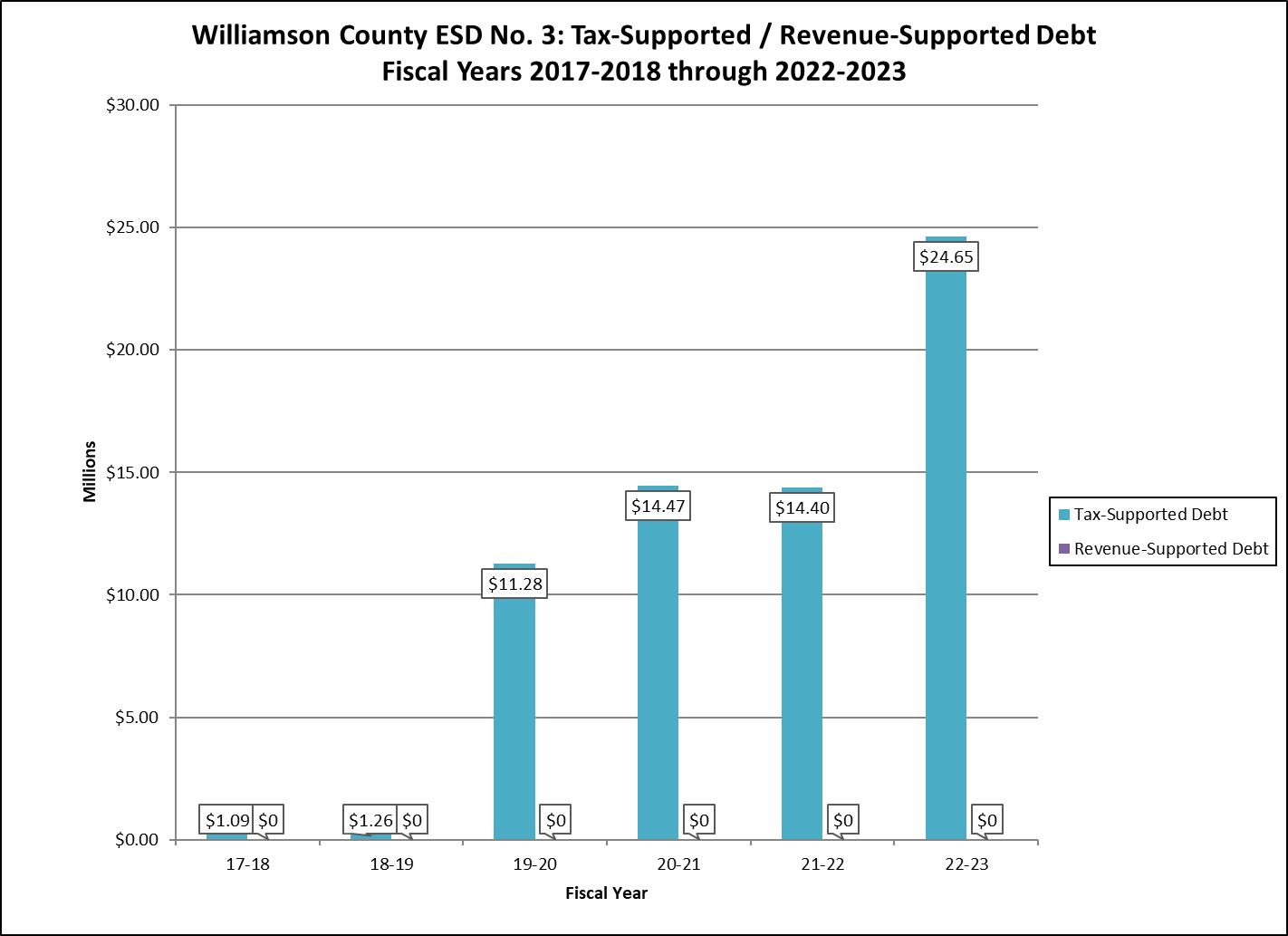

Williamson County Emergency Services District #3 debt is supported by a portion of the Total Property Tax levied per year. There is no revenue-supported debt incurred by Williamson County Emergency Services District #3, nor has there been any type of bond election planned (https://www.brb.texas.gov/local-government-services/). Williamson County Emergency Services District # 3 needs do not rise to a level large enough to offset the expenses related to a bond issuance. Therefore, Williamson County Emergency Services District # 3 acquires debt directly from financial institutions through a competitive request for proposal (RFP) process to ensure the lowest rate opportunity. Williamson County Emergency Services District # 3 Board of Commissioners approved financial policies guide the level of debt acquired by Williamson County Emergency Services District #3 and is reviewed each time new debt is considered and annually during the fiscal year Budget development process.

In 2017, the 85th Legislature passed a transparency bill requiring certain special purpose districts to annually provide records and other information concerning district finances and tax rates to the Comptroller of Public Accounts (See Senate Bill 625 (SB 625)). SB 625 also required the Comptroller of Public Accounts to create the Special Purpose District Public Information Database, where information submitted by the districts will be assembled, updated, and made available to the public free of charge. The most recent Local Annual Debt Report, as required by Texas Local Government Code §140.008, can be found at the Texas Comptroller of Public Accounts Debt at a Glance Tool (DAAG). Williamson County Emergency Services District #3 debt can be found here.

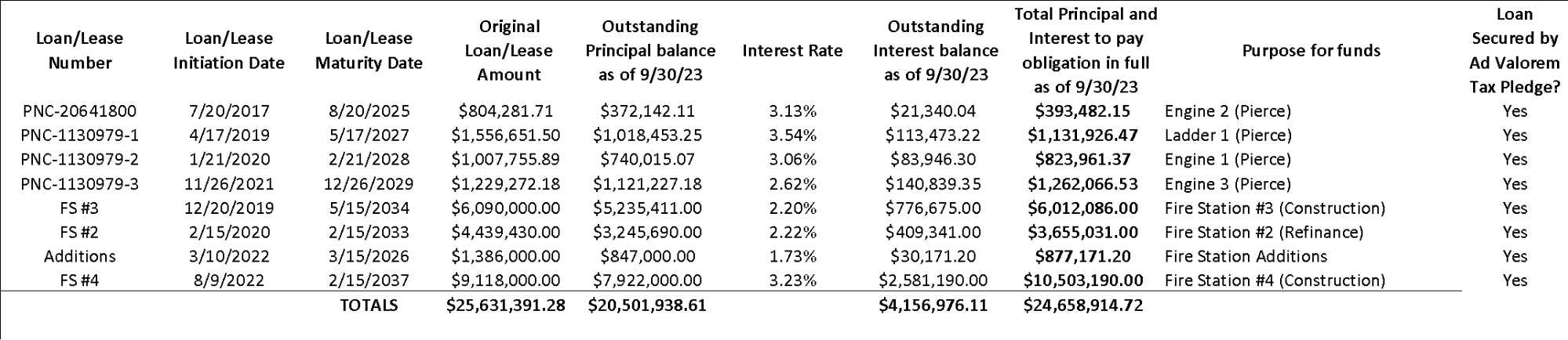

Total outstanding debt obligations for Williamson County Emergency Services District # 3 as of 9/30/2023 are:

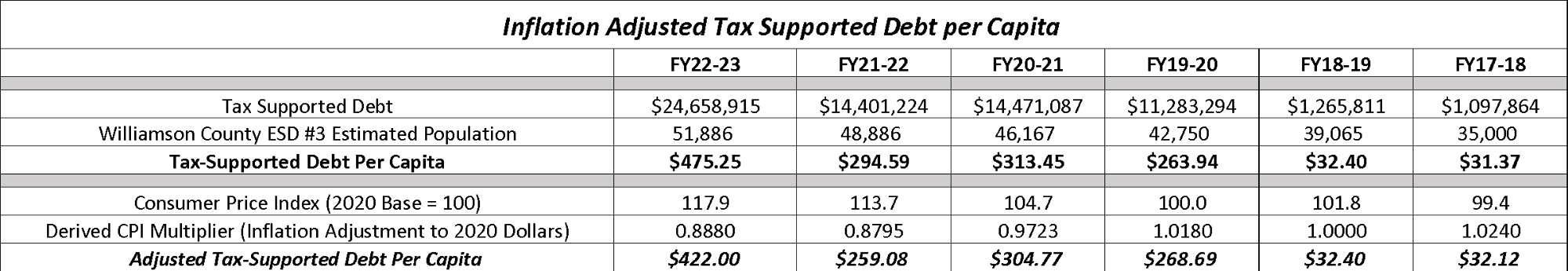

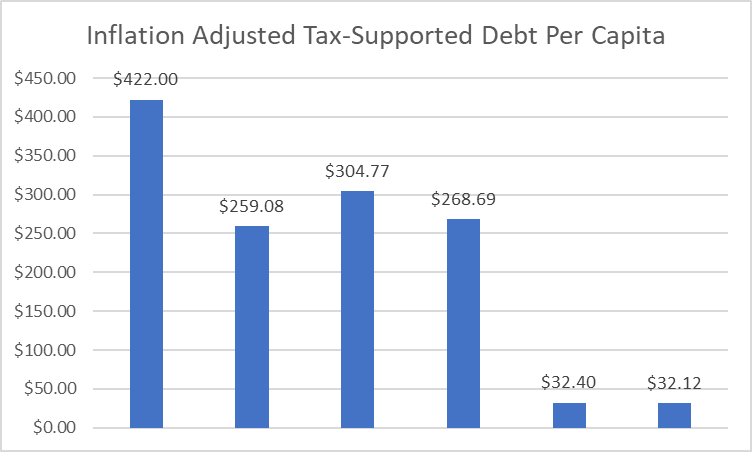

Historical trends for total tax-supported debt obligations for Williamson County Emergency Services District #3 are:

The Williamson County Emergency Services District #3 Inflation-Adjusted Tax-Supported Debt Per Capita is shown below:

Current debt obligations (raw data) include:

Sales and Use Tax (Outside the Hutto City Limits Only)

The State of Texas imposes a 6.25 percent sales tax across the state. Local jurisdictions can levy a total of two percent; under Texas law, then, the maximum sales tax that can be collected is 8.25 percent. In 2016 the residents of Williamson County Emergency Services District #3 living outside of the Hutto city limits voted for a 2.0₵ Sales and Use Tax (SUT) to be used for the construction of fire stations, the purchasing of fire apparatus, and the hiring of firefighters.

Public Pension System

Williamson County Emergency Services District #3, a State of Texas Special Purpose District, has participated in the Texas County and District Retirement System (TCDRS) since 2010. TCDRS was created by the Texas Legislature in 1967. TCDRS helps more than 360,000 Texans plan for their future through partnerships with counties and districts to provide retirement, disability and survivor benefits. TCDRS serves 253 Texas counties and 595 diverse districts — such as Williamson County Emergency Services District #3. Providing attractive retirement benefits helps Williamson County Emergency Services District #3 competitively hire and retain talented staff.

Since TCDRS was created, they have grown into a financially strong, multi-billion-dollar trust with nearly 850 participating employers such as Williamson County Emergency Services District #3. TCDRS employers advance fund their plans over the length of their employees’ careers so their employees can count on their benefits when they are ready to retire. TCDRS is considered one of the best-funded retirement plans in the nation; they do not receive state funding. Each plan is funded by investment earnings (74%), the employer (15%) and its employees (11%). Benefits are responsibly funded, which means costs are not pushed to future generations. TCDRS consistently exceeds their portfolio benchmark. For example, a 35-year return at 8.6% for the period ending Dec. 31, 2021.

Williamson County Emergency Services District #3 retirement plan through TCDRS is built-in on three features that make it financially strong.

1 – SAVINGS-BASED: Williamson County Emergency Services District #3 employees save for their own retirement over the length of their careers. The TCDRS benefit is based on the final savings balance and employer matching. This is contrary to a traditional pension based on final salary where a late-career promotion or excessive overtime can increase employer costs beyond expectations.

2 – RESPONSIBLE FUNDING: Williamson County Emergency Services District #3 pays 100% of their required contribution every year. This ensures that the necessary funds will be there when the time comes to pay benefits upon separation from the organization.

3 – FLEXIBILITY AND LOCAL CONTROL: Williamson County Emergency Services District #3 can adjust benefit levels to meet workforce needs and budgets. This level of flexibility is not standard in most traditional pension plans.

As of Dec. 31, 2022 TCDRS’ net assets were $42 billion. Their portfolio is constructed to achieve their long-term return goal within acceptable levels of risk. By meeting their goals, they help employers provide meaningful, secure benefits to their employees and retirees at reasonable, predictable costs. TCDRS investment returns and net of all fees include the following:

|

ANNUALIZED RETURN |

2022 RETURN |

RETURNS AS OF DEC. 31, 2022 | ||||

|

5 YEAR |

10 YEAR |

20 YEAR |

30 YEAR |

40 YEAR |

||

|

Total Fund |

-5.8% |

7.8% |

8.3% |

7.8% |

7.6% |

9.0% |

|

Policy Benchmark Portfolio |

-8.8% |

6.1% |

6.8% |

6.9% |

6.5% |

7.8% |

Effective March 2023 the TCDRS investment portfolio provided broad diversity to reduce their total exposure to losses from any single asset class or investment.

In 2022, TCDRS paid $2.1 billion in benefits to retirees and former members, and 96% of that money stayed in Texas.

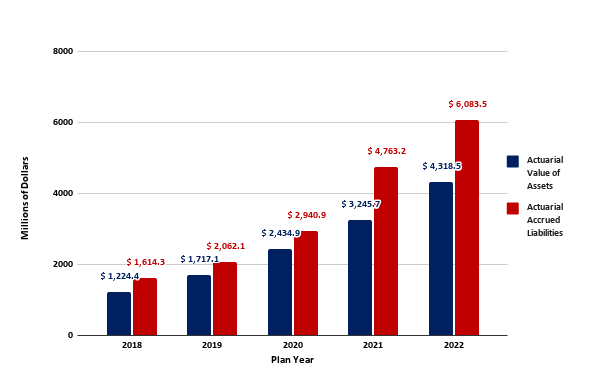

Williamson County Emergency Services District #3 most recently completed fiscal year for which data is available: 2022

-

- Williamson County Emergency Services District #3 funded ratio from most recent actuarial valuation: 71.0

- Williamson County Emergency Services District #3 amortization period from most recent actuarial valuation: 16.10

- Williamson County Emergency Services District #3 one-, three- and 10-year rates of return, with link to basic explanation of methodology employed:

- One-year rate: -5.80%

- Three-year rate: explanation: 8.29%

- Ten-year rate: 8.27%

- Williamson County Emergency Services District #3 assumed rate of return: 7.50%

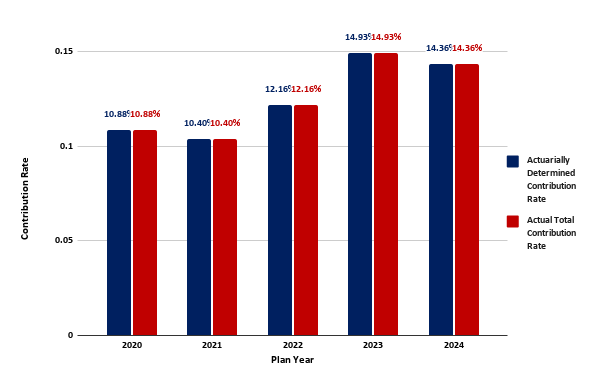

- Williamson County Emergency Services District #3 Actuarially Determined Contribution (ADC) Rate from most recent actuarial valuation: 14.36%

- Williamson County Emergency Services District #3 current total Contribution Rate from most recent actuarial valuation: 14.43%

- Williamson County Emergency Services District #3 Unfunded Actuarial Accrued Liability (UAAL) as percent of covered payroll from most recent actuarial valuation: 3.64%

TCDRS investment return results

TCDRS investment results explanation of methodology

Texas Comptroller of Public Accounts Public Pension (Total) search tool

Texas Comptroller of Public Accounts Public Pension (TCDRS only) search tool

Williamson County Emergency Services District #3 Documents and Reports

WCESD #3 Actuarial Accrued Assets vs. Actuarial Accrued Liabilities 2018-2022

WCESD #3 Actuarially Determined Contribution Vs Actual Total Contribution Rate 2020-2024

- WCESD #3 Actuarially Determined Contribution Vs Actual Total Contribution Rate 2020-2024 (Raw Data)

- 2022 TCDRS Schedule of Changes in Fiduciary Net Position by Employer (Total)

- 2021 TCDRS Schedule of Changes in Fiduciary Net Position by Employer (Total)

- 2020 TCDRS Schedule of Changes in Fiduciary Net Position by Employer (Total)

- 2019 TCDRS Schedule of Changes in Fiduciary Net Position by Employer (Total)

- 2018 TCDRS Schedule of Changes in Fiduciary Net Position by Employer (Total)

- 2018 WCESD #3 Plan Assessment

- 2019 WCESD #3 Plan Assessment

- 2020 WCESD #3 Plan Assessment

- 2021 WCESD #3 Plan Assessment

- 2022 WCESD #3 Plan Assessment

- 2018 WCESD #3 Summary Valuation Report

- 2019 WCESD #3 Summary Valuation Report

- 2020 WCESD #3 Summary Valuation Report

- 2021 WCESD #3 Summary Valuation Report

- 2022 WCESD #3 Summary Valuation Report

Contracts and Procurements

Williamson County Emergency Services District #3, a State of Texas Special Purpose District, follows a decentralized business model with each division and section handling all non-construction goods and services for themselves. Construction and engineering requests for proposals are administered by the Fire Chiefs Office. It is the responsibility of Williamson County Emergency Services District #3 to conduct purchasing in accordance with all applicable laws and regulations, to foster sound purchasing policies and procedures, and to stimulate competitive bidding to provide materials and services at the lowest price and highest quality possible. Non-construction debt goods and services (i.e., engines, ladders, staff vehicles, etc.) are purchased by using one of three cooperative purchasing programs in Texas. These local government purchasing cooperatives increase the purchasing power of government entities. Combining the purchase power of local governments provides all members the leverage to achieve better pricing on products, equipment, and services they use every day. Click here to go to the Contracts and Procurements page for complete information on all Williamson County Emergency Services District #3 construction contracts and projects.

Current Financial Information

The Texas Constitution requires local taxing units, such as Williamson County Emergency Services District # 3, to make taxpayers aware of tax rate proposals and to afford taxpayers the opportunity to roll back or limit tax increases.

As a property owner you are encouraged to use the Williamson County Tax Assessor/Collector’s property taxes website to find information concerning your estimated taxes, the taxing units to which your taxes are distributed, the dates and locations of any public hearings where your locally elected officials determine your tax rates, and other important property tax information. Questions concerning Williamson County Emergency Services District #3 taxes can be addressed to taxes@huttofirerescue.org.

Your 2023 property values were available in early August and tax rates were available shortly after. To estimate taxes, please visit the Tax-estimator website.

- Williamson Central Appraisal District FY2023- 2024 Assessed Valuation for Williamson County Emergency Services District #3

- Williamson County Emergency Services District #3 FY2023-2024 Adopted Budget (October 1, 2023 to September 30, 2024)

- Williamson County Emergency Services District #3 FY2023-2024 Adopted Budget (October 1, 2023 to September 30, 2024) – [Raw Data Quarterly Posting]

- Williamson County Emergency Services District #3 FY2023-2024 Check Register (Raw Data Quarterly Posting)

- Williamson County Emergency Services District #3 Truth-in-Taxation Calculations

- Williamson County Emergency Services District #3 Notice About FY2023-2024 Tax Rates

- Williamson County Emergency Services District #3 Notice of Public Hearing on Tax Increase

- Williamson County Emergency Services District #3 Anticipated Collection Rate

- Williamson County Emergency Services District #3 Special Purpose Debt Report

Contact Information

Williamson County Emergency Services District #3 Board of Commissioners contact information can be found here.

Williamson County Emergency Services District #3 contact information:

HUTTO FIRE RESCUE

210 US Hwy 79, Suite 103

Hutto, TX 78634

Phone: 512-759-2616

Email: info@huttofirerescue.org

Williamson County Emergency Services District #3 Board Meeting Agendas and Minutes can be found here.

Williamson County Emergency Services District #3 details for Public Information Requests can be found here.

Historical Financial Information

Fiscal Year 2022-2023 (October 1, 2022 to September 30, 2023)

- FY22-23 Assessed Valuation

- FY22-23 Adopted Budget

- FY22-23 Audited Financial Statements

- FY22-23 Check Register

- FY22-23 Check Register – Raw Data

- FY22-23 Investment Quarterly Investment Reports

- FY22-23 Budget Adjustments & Line-Item Transfers

Fiscal Year 2021-2022 (October 1, 2021 to September 30, 2022)

- FY21-22 Assessed Valuation

- FY21-22 Adopted Budget

- FY21-22 Audited Financial Statements

- FY21-22 Check Register

- FY21-22 Check Register – Raw Data

- FY21-22 Investment Quarterly Investment Reports

- FY21-22 Budget Adjustments & Line-Item Transfers

Fiscal Year 2020-2021 (October 1, 2020 to September 30, 2021)

- FY20-21 Assessed Valuation

- FY20-21 Adopted Budget

- FY20-21 Audited Financial Statements

- FY20-21 Check Register

- FY20-21 Check Register – Raw Data

- FY20-21 Investment Quarterly Investment Reports

- FY20-21 Budget Adjustments & Line-Item Transfers

Fiscal Year 2019-2020 (October 1, 2019 to September 30, 2020)

- FY19-20 Assessed Valuation

- FY19-20 Adopted Budget

- FY19-20 Audited Financial Statements

- FY19-20 Check Register

- FY19-20 Check Register – Raw Data

- FY19-20 Investment Quarterly Investment Reports

- FY19-20 Budget Adjustments & Line-Item Transfers

Fiscal Year 2018-2019 (October 1, 2018 to September 30, 2019)

- FY18-19 Assessed Valuation

- FY18-19 Adopted Budget

- FY18-19 Audited Financial Statements

- FY18-19 Check Register

- FY18-19 Check Register – Raw Data

- FY18-19 Investment Quarterly Investment Reports

- FY18-19 Budget Adjustments & Line-Item Transfers

Fiscal Year 2017-2018 (October 1, 2017 to September 30, 2018)

- FY17-18 Assessed Valuation

- FY17-18 Adopted Budget

- FY17-18 Audited Financial Statements

- FY17-18 Check Register

- FY17-18 Check Register – Raw Data

- FY17-18 Investment Quarterly Investment Reports

- FY17-18 Budget Adjustments & Line-Item Transfers

Fiscal Year 2016-2017 (October 1, 2016 to September 30, 2017)

- FY16-17 Assessed Valuation

- FY16-17 Adopted Budget

- FY2017 Audited Financial Statements

- FY16-17 Check Register

- FY16-17 Check Register – Raw Data

- FY16-17 Investment Quarterly Investment Reports

- FY16-17 Budget Adjustments & Line-Item Transfers

Fiscal Year 2015-2016 (October 1, 2015 to September 30, 2016)

- FY15-16 Assessed Valuation

- FY15-16 Adopted Budget

- FY15-16 Audited Financial Statements

- FY15-16 Check Register

- FY15-16 Check Register – Raw Data

- FY15-16 Investment Quarterly Investment Reports

- FY15-16 Budget Adjustments & Line-Item Transfers

Fiscal Year 2014-2015 (October 1, 2014 to September 30, 2015)

- FY14-15 Assessed Valuation

- FY14-15 Adopted Budget

- FY14-15 Audited Financial Statements

- FY14-15 Check Register

- FY14-15 Check Register – Raw Data

- FY14-15 Investment Quarterly Investment Reports

- FY14-15 Budget Adjustments & Line-Item Transfers

Fiscal Year 2013-2014 (October 1, 2013 to September 30, 2014)